Contents

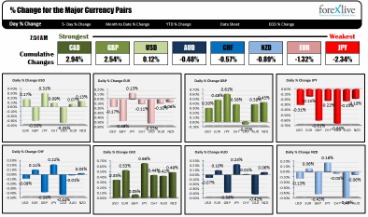

The https://topforexnews.org/ and ask are always fluctuating, so it’s sometimes worthwhile to get in or out quickly. At other times, especially when prices are moving slowly, it pays to try to buy at the bid or below, or sell at the ask or higher. An offer placed below the current bid will narrow the bid-ask spread, or the order will hit the bid price, again filling the order instantly because the sell order and buy order matched. If the current stock is offered at $10.05, a trader might place a limit order to also sell at $10.05 or anywhere above that number. Say that a buy order is placed with a limit of $10.08, then all other offers lower than that price (starting here with $10.05) must be filled before the price moves up to $10.08 and potentially fills the order. Again, there’s no guarantee that an offer will be filled for the number of shares, contracts, or lots the trader wants.

In the following https://en.forexbrokerslist.site/s you will see an example of how the TY traded much higher in the ETH’s session after the RTH session settlement price was much lower. Our Trade Ideas review uncovers an excellent stock scanner, an AI-powered trading signal platform with 30 channels of trading ideas and auto-trading. Three automated Holly AI systems pinpoint trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns. If the company has poor financial performance, low profits, or poor products, the company will be deemed by the shareholders to be worthless; therefore, sell the shares, and the price will drop. The 52-week range is the value between which the stock price has moved over the last 52 weeks of trading.

The occurrence of the last traded price or LTP depends on the liquidity of the market, based on which the last traded price or LTP could have occurred a few seconds ago or even a day ago. VRD Nation is a premier online stock market training institute where we teach by trading live. We are on a mission to make working class people financially independent and get Trading its rightful place as a viable career option. One of the reasons the exchanges calculate closing prices rather than just taking LTP is to avoid any last minute price manipulation.

William Price to Quebec.William Price was born in 1789 into a well off and well-educated Welsh family originally from Glamorgan. However, his father died in 1803, leaving the family with eight children under 21 years of age, a large but old mansion in the outskirts of London, and a crippling debt. The home was turned into a boarding house to support the family. They were patrons of the arts as well, in particular of the portrait painter Gainsborough. The best known of these Prices was Uvedale Price, who wrote the Essay on the Picturesque, As Compared with the Sublime and The Beautiful in 1794. Rhys ap Meredydd fought for Henry Tudor at Bosworth Field in 1485.

Example of Closing Prices: Line Graphs

Stock prices increase because the people who want to buy a share of that company believe that the company is worth more than the current price. If the number of people who believe the company is worth more than the current price outweighs the number of people who believe it is worth less , then the stock price will rise. If a stock is liquid, it means that there is plenty of money lubricating the trading of the stock. For example, if many people exchange the stock daily and money flows in and out of the stock, it is deemed highly liquid.

Because there are more people who want pineapples and fewer pineapples available, the price will naturally rise as people will bid higher . The stock might not have a lot of liquidity; therefore, it may be harder to sell at the price or time you wish to. If a bid is $10.05, and the ask is $10.06, the bid-ask spread would then be $0.01. However, this would be simply the monetary value of the spread. The bid-ask spread can be measured using ticks and pips—and each market is measured in different increments of ticks and pips.

- So if you were to sell the stock now, you would get the price you asked as long as the bidder is willing to pay it.

- A security’s closing price is the standard benchmark used by investors to track its performance over time.

- This is the official price from the Exchange that will be used for accounting procedures for the winners and losers of the day.

- Similarly, always selling at the bid means a slightly lower sale price than selling at the offer.

An unusually short lifespan might indicate that your Price ancestors lived in harsh conditions. A short lifespan might also indicate health problems that were once prevalent in your family. The SSDI is a searchable database of more than 70 million names. Save taxes with ClearTax by investing in tax saving mutual funds online.

He too worked for David’s shipping company and in 1810, at the age of twenty one, was sent to Quebec as a clerk. He saw the new opportunities in timber in Canada and by 1820 had started with three partners his own lumber company. His daily entries were made on odd scraps of paper, over 3,000 of them, that he carried around with him, loosely fastened together with string. This extraordinary forty-year document offers a treasure trove of details of Lower Merion life in that era and a testament to the varied skills and interests of an extraordinary ordinary man.

Stock Rover Review 2023: The Best For Smart US Investors!

A reverse stock split causes a similarly dramatic price change. A particularly dramatic change in price occurs when a company announces a stock split. When the change is made, the price displayed will immediately reflect the split. For example, if a company splits its stock 2-for-1, the last closing price will appear to be cut in half. That change would be reflected in the adjusted closing price. The session price is the price of a stock over the trading session and may sometimes refer to a stock’s closing price.

To be familiar with the term, last traded price or LTP, let’s look at it in a little bit of detail. If the closing prices of the stock increased daily, the line would slope upward and to the right. Conversely, if the price of the stock was steadily decreasing, then the line would slope downward and to the right. It means that the market has dropped and someone is willing to sell below the last traded price. So there is some level of selling pressure that is driving prices down. It’s possible to base a chart on the bid or ask price as well, however.

He was a huge man and, according to legend, slew the English King Richard III with his own hands. His son Sir Robert ap Rhys served Henry VII and was a cross-bearer to Cardinal Wolsey in the 1530’s. Coming from an impoverished Welsh family in London, he arrived in Quebec in 1810 as a young man with a mandate to supply lumber for the British navy. George Pryce left Jamaica for America as a young man in the 1880’s and graduated as a young “black” doctor in Tennessee. He went on to found Pryce’s Pharmacy in Los Angeles, a drugstore on the corner of Pryce Street which is run by his grandson today. One line under Captain John Price migrated to Kentucky in the 1790’s.

Similarly, if someone submits a better priced sell order that does not reach the price of the best buy order, the ask price will update to reflect that new order and the spread will narrow. Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. The British first settled the British West Indies around 1604. They made many attempts but failed in some to establish settlements on the Islands including Saint Lucia and Grenada. By 1627 they had managed to establish settlements on St. Kitts (St. Christopher) and Barbados, but by 1641 the Spanish had moved in and destroyed some of these including those at Providence Island.

Efiling Income Tax Returns is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. If you are new to the trading world, the terminologies used in this world may be a little confusing at the start.

“Trading floor” refers to an area where trading activities in financial instruments, such as equities, fixed income, futures, etc., takes place. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Price (surname)

If a company is making great profits, paying dividends, or has a stellar future , the stock price will rise. The 52-week high-low is a useful indicator to show the range of trading in the last year, the Highest and Lowest levels of the stock price. Let’s go into the video in-depth with a step-by-step explanation of each of the many stock price elements.

Good volume means good liquidity, meaning there is enough money to keep the bid-ask spreads tight. This means you can usually sell for the price you want at the time you want. If there is low trading volume and many gaps in stock price bars, this is a low volume warning sign. The adjusted closing price factors in anything that might affect the stock price after the market closes, such as dividends or splits. Most stocks and other financial instruments are traded after-hours, although in far smaller volumes. Therefore, the closing price of any security is often different from its after-hours trading price.

To make matters more perplexing, the https://forex-trend.net/ price you see when you search for a quote online is often a consolidated quote. This quote is delivered via a system that pulls transactions from all of the stock exchanges and puts them into one data stream. When traders come from trading the Equity market into trading the Futures markets, they will need to understand a subtle nuance in Futures charting. While there are many, I will focus on the difference between a settlement price and a last trade price for this article.

This Benzinga Pro review reveals it is best for traders who want a high-speed actionable real-time news feed at 1/10th of the price of a Bloomberg terminal. Benzinga Pro includes charts, financials, screening, options mentoring, and a powerful calendar suite to get a trading edge. Some traders seek to buy stocks at the height of the 52-week range as they expect a pull-back. Other traders buy at the height of the 52-week range expecting a stock price breakout to new highs. A good 52-week range depends on your personal trading or investing style and strategy. In the case of Netflix on the Nasdaq Stock Exchange, lots of shares are traded every day.

The difference between the bid and the ask is called the spread. It just shows the price difference between the best priced buy order, and the best priced sell order. A locked market is where a buy order at one exchange isthe same price as a sell order at another exchange.